Fiscal Processors

The Fiscal Processor is the component that is responsible for the compliance of the fiscal law when the country fiscal law or its implementation delegates the fiscal responsibility to a software component rather than an hardware device (i.e. Fiscal Printer)

Usually the Fiscal Processor is used in conjunction with the TKRP_GENERIC print driver.

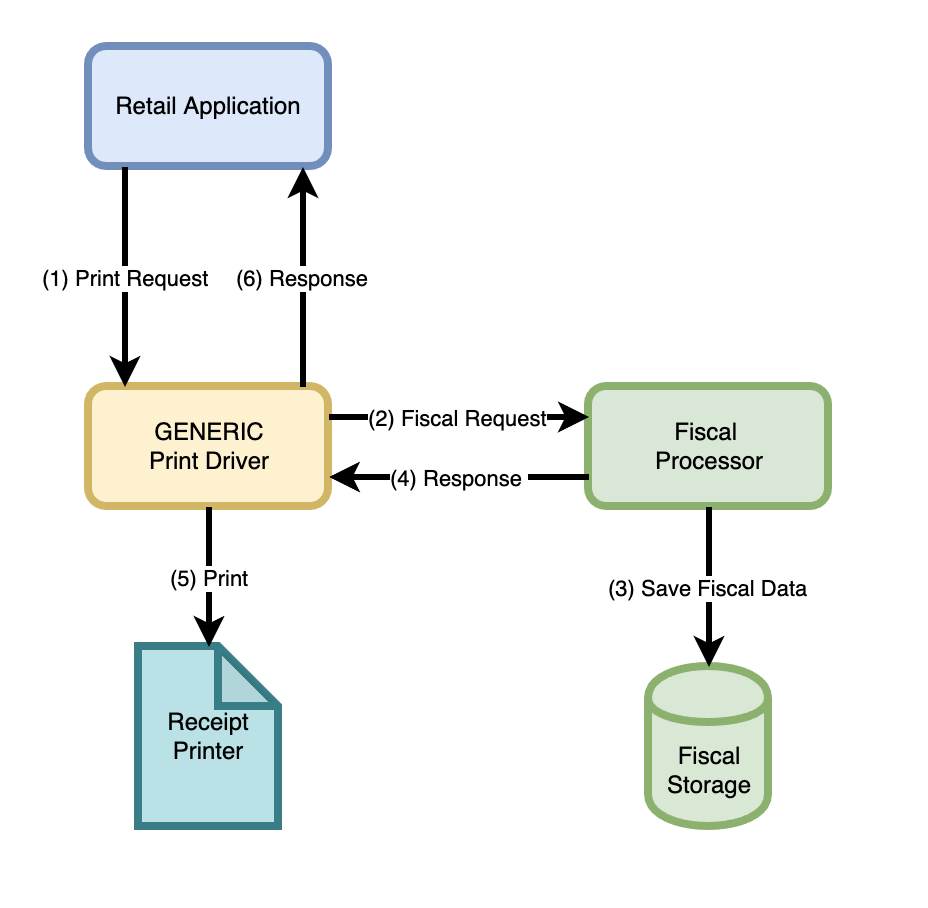

Communication and Process Schema

The Communication Schema between the components is the following

The Retail Application calls a Driver Method specifying the Fiscal Processor delegation

The Print Driver, if the request has “fiscal” impacts, calls the Fiscal Processor passing it the receipt document

The Fiscal Processor:

Analyzes the receipt document

Performs the fiscal activities requested by the country fiscal law

Integrate the receipt document with the fiscal needed information

Stores the fiscal relevant data in the fiscal storage so that they can be accessible in case of a fiscal verification

The Fiscal Processor returns the updated Receipt Document to the Print Driver

If no error has been reported by the Fiscal Processor, the Print Driver prints the receipt

The Print Driver send the response to the Retail Application

Notes

The following behaviors are intended just as “expected standard behaviors”. The real behavior is dependent by the implementation of each Fiscal Processor Driver

A Fiscal Processor error will prevent the receipt to be printed

The Fiscal Processor process is usually definitive and cannot be rolled-back

The transaction is considered valid even if the receipt printer cannot print it. In this case a document reprint can be performed by the retail application